5 Common Receipt Management Mistakes (And How to Avoid Them)

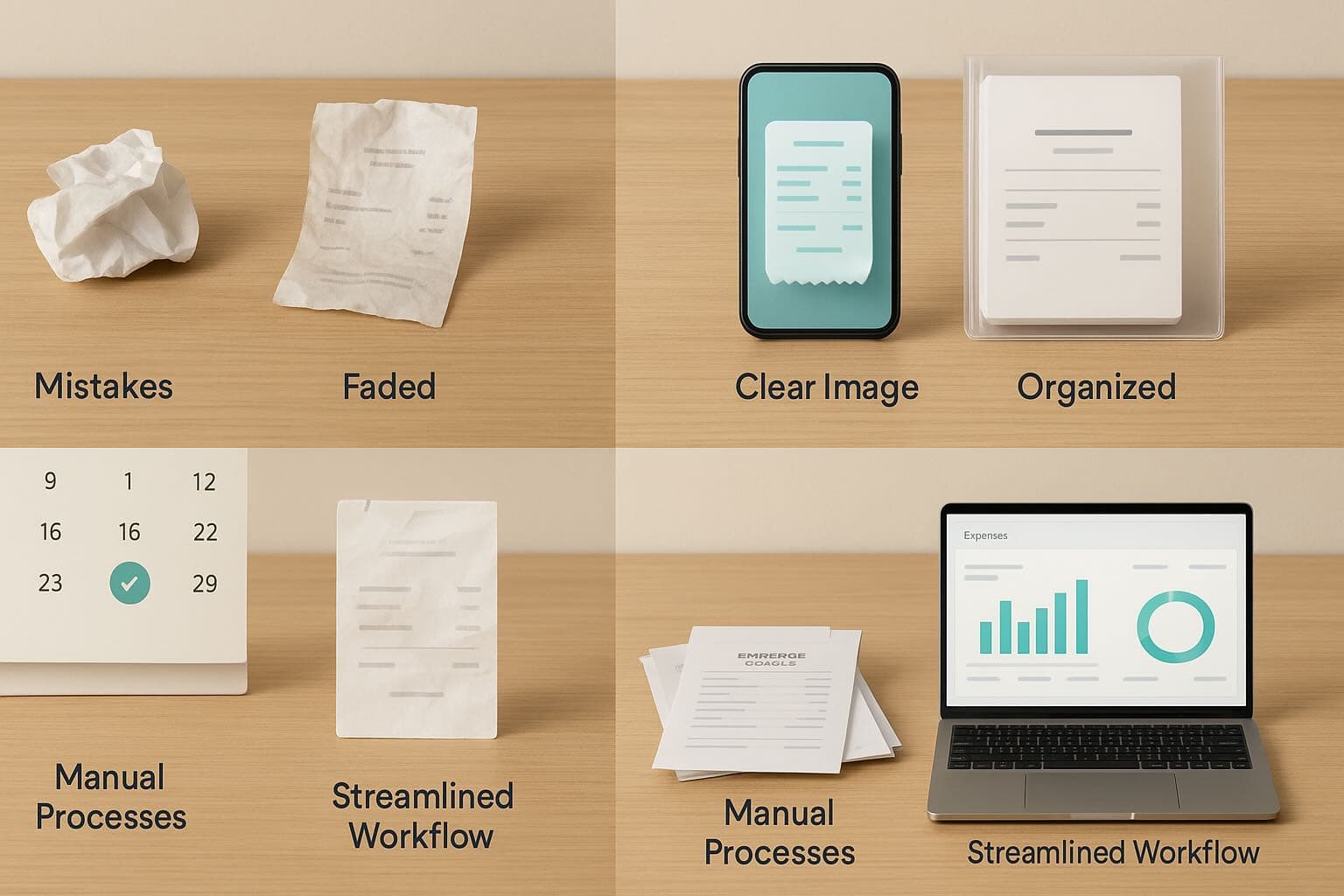

Receipt management might seem straightforward—snap a photo, file it away, done. Yet countless businesses struggle with expense chaos every month-end. These mistakes cost time, money, and sometimes trigger compliance headaches during audits. We have analyzed thousands of receipt workflows, and five patterns emerge repeatedly. Here is what teams get wrong—and how Receipt Reader AI helps fix it.

Mistake #1: Waiting Until Month-End

The Problem: Many employees accumulate receipts throughout the month, planning a big catch-up session before the accounting deadline. By then, receipts have faded, details blur together, and the process becomes a dreaded marathon. What should take minutes per receipt now demands hours of forensic reconstruction.

Why It Happens: People underestimate the memory decay curve. A week after the transaction, you might recall whether it was a client dinner or team lunch. Four weeks later? That vendor name means nothing, and you are guessing at the business purpose. Physical receipts also degrade—thermal paper fades, and paper gets crumpled or lost.

The Real Cost: Delayed capture creates a bottleneck at month-end when accounting teams are already slammed. It also reduces data accuracy, leading to miscategorized expenses or missing deductions. One retail client told us their team spent 8 hours every month reconstructing expense context from faded receipts.

The Fix: Adopt a capture immediately policy. Train your team to photograph or forward receipts within 24 hours—ideally at the point of purchase. Receipt Reader AI makes this frictionless with mobile capture: open the app, snap the receipt, and AI extraction handles the rest. The entire workflow takes 15 seconds, and you never lose critical context.

Set calendar reminders if needed, or implement a policy where expense submissions older than 72 hours require manager approval. This gentle friction encourages timely behavior without creating bureaucracy.

Mistake #2: Inconsistent Categorization

The Problem: Without standardized categories, expenses scatter across arbitrary labels. One person calls it Meals and Entertainment, another uses Client Dinners, and a third just writes Food. When tax season arrives, you are manually sorting through hundreds of variations, trying to reconcile what should have been consistent from day one.

Why It Happens: Teams often start with vague guidelines—use your best judgment—and never revisit the system. Individual contributors create categories on the fly, and before long, your chart of accounts looks like a taxonomy designed by committee.

The Real Cost: Inconsistent categories destroy reporting accuracy. You cannot analyze spend trends when half your software subscriptions are filed under IT Services and the other half under Online Tools. Auditors hate it, accountants waste hours reclassifying, and CFOs get unreliable data.

The Fix: Build a master category list with clear definitions and examples. Limit the list to 15-25 categories to prevent analysis paralysis. For example:

- Meals and Entertainment: Client dinners, team lunches, conference meals

- Travel: Flights, hotels, rideshares during business trips

- Office Supplies: Stationery, printer ink, desk accessories

- Software and Subscriptions: SaaS tools, cloud storage, productivity apps

Receipt Reader AI learns your category preferences through a simple correction loop. The first few times you reclassify a Starbucks receipt as Team Meals instead of Office Supplies, the AI adapts. Within weeks, it auto-categorizes with 95%+ accuracy, and your team just needs to review rather than manually tag every entry.

Document your categories in a shared wiki or onboarding guide. Run quarterly audits to catch drift and merge near-duplicate labels.

Mistake #3: Incomplete Documentation

The Problem: A receipt proves you spent money, but it does not explain why or with whom. During an audit, a $200 restaurant charge with no context becomes a red flag. Was it a client meeting, a team celebration, or personal dining? Without documentation, you risk disallowed deductions or uncomfortable explanations.

Why It Happens: People assume they will remember details later, or they view documentation as bureaucratic overhead. Employees also resist writing notes when the submission process is clunky—three form fields, a dropdown menu, and a text box scattered across a slow web interface.

The Real Cost: The IRS requires adequate records for business expenses, which means date, amount, place, business purpose, and business relationship. Missing any element can disqualify the deduction. Beyond compliance, poor documentation wastes time during internal reviews when managers have to chase down employees weeks later asking, What was this $75 Uber for?

The Fix: Capture context immediately while details are fresh. Receipt Reader AI prompts for optional notes and attendees during mobile submission—right after you snap the photo. Add Client meeting with Sarah from Acme Corp to discuss Q2 contract in 10 seconds, and you are covered.

For recurring vendors, the app suggests past notes: Last time you expensed Starbucks, you wrote Team standup coffee. Same reason? One-tap confirmation keeps documentation consistent without repetitive typing.

For high-value or sensitive expenses (over $75, international charges, or unusual categories), require manager approval before submission. This adds a checkpoint where incomplete documentation gets caught early.

Mistake #4: No Reconciliation

The Problem: Teams submit expenses into a black hole—receipts go in, nobody checks if they match bank statements or corporate card transactions. Months later, discrepancies surface: duplicate charges, missing receipts, personal expenses accidentally submitted. Untangling the mess demands forensic accounting, and some errors never get caught.

Why It Happens: Reconciliation feels tedious, and many systems do not make it easy. Manual cross-referencing between expense reports, bank feeds, and corporate card statements requires spreadsheet gymnastics. Teams skip it until a quarterly audit forces a reckoning.

The Real Cost: Unreconciled expenses hide fraud, inflate costs, and undermine financial reporting. One manufacturing client discovered $12,000 in duplicate reimbursements over six months—not intentional fraud, just sloppy processes nobody was checking. Frequent reconciliation also prevents small errors from snowballing into major headaches.

The Fix: Institute weekly 15-minute reconciliation reviews. Compare submitted receipts against bank transactions and flag anomalies: missing receipts, amount mismatches, or unusual spending patterns. Receipt Reader AI simplifies this with automated matching—it compares OCR-extracted totals against imported bank feeds and highlights discrepancies.

For corporate card programs, enable real-time receipt matching: when an employee swipes the card, a push notification prompts them to submit the receipt immediately. The transaction and receipt link automatically, and your reconciliation becomes near-instant.

Assign reconciliation ownership to a finance team member or manager. Make it a standing calendar event, not an ad hoc task. Consistency matters more than perfection—a quick weekly check catches 90% of issues before they compound.

Mistake #5: Treating All Expenses the Same

The Problem: A $5 coffee and a $5,000 vendor payment should not follow identical approval workflows, yet many systems enforce uniform processes. Employees get frustrated waiting for manager sign-off on trivial purchases, while high-value transactions slip through without adequate scrutiny.

Why It Happens: Organizations default to one-size-fits-all policies because tiered systems feel complex to implement. Leadership fears that carve-outs will create loopholes, so they apply blanket rules that frustrate everyone equally.

The Real Cost: Uniform policies waste time (managers approving $8 lunches) and create risk (nobody reviewing $2,000 software renewals). They also demoralize employees who feel micromanaged on petty expenses while genuinely important spending lacks oversight.

The Fix: Implement tiered expense management based on amount, category, and risk profile:

- Tier 1 (Under $50, common categories): Auto-approved. Employee submits, system logs it, accounting reconciles monthly. Examples: coffee, parking, office supplies.

- Tier 2 ($50-$500, standard categories): Manager review within 48 hours. Examples: client meals, local travel, minor software tools.

- Tier 3 (Over $500, sensitive categories, international): Finance team review, requires documentation and business justification. Examples: conference travel, major vendor payments, equipment purchases.

Receipt Reader AI supports tiered workflows natively: configure approval rules by amount, category, department, or custom tags. When an employee submits a $600 flight, the system routes it to their manager and finance automatically. A $6 coffee? Logged and done.

Review thresholds quarterly to adjust for inflation, spending patterns, or policy changes. Communicate tiers clearly during onboarding so employees understand expectations upfront.

Moving Forward

These five mistakes share a common thread: they are all process failures, not people failures. Employees do not want to create expense chaos—they are just navigating systems that make good behavior hard and bad behavior easy. Fix the system, and behavior follows.

Receipt Reader AI was built to make the right behaviors effortless: instant capture, smart categorization, structured documentation, automated reconciliation, and flexible workflows. Teams reclaim 1-3 days per month previously lost to expense wrangling, and CFOs get cleaner data with audit-ready documentation.

Ready to fix your expense process? Start a free 14-day trial and experience the difference that purpose-built receipt management makes.